DIEBOLD, MASTERCARD TO PILOT CARDLESS ATM SOLUTIONS

Diebold Nixdorf is teaming up with MasterCard to pilot test two cash provision services — MasterCard Cash Pick-Up and Cardless ATM powered by MasterCard.

With MasterCard Cash Pick-Up, banks can enable their ATMs to deliver cash easily and securely to any authenticated consumer — banked or unbanked — without the use of a card, a press release said.

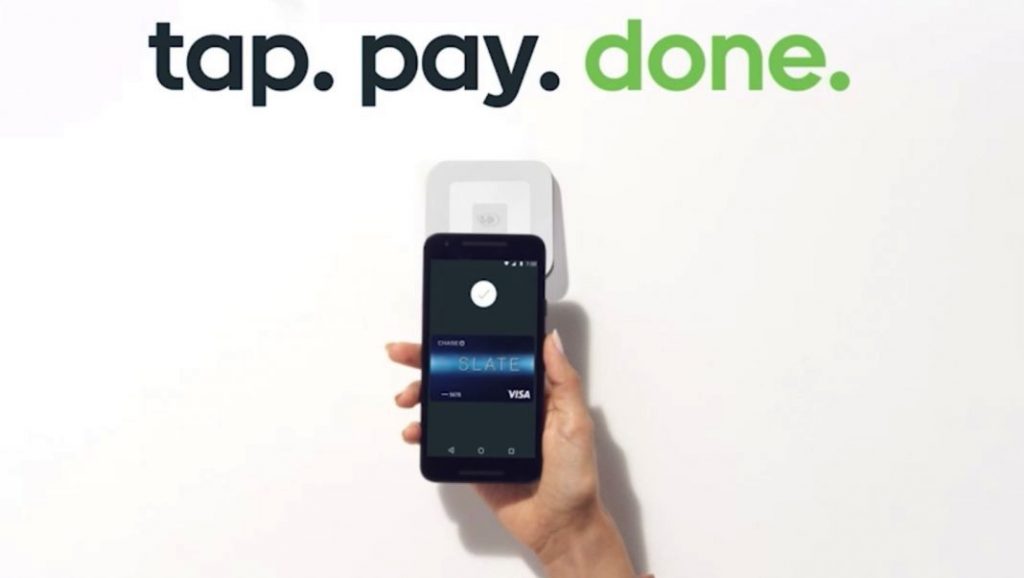

Cardless ATM powered by MasterCard allows accountholders to withdraw cash from the nearest ATM using their mobile banking app. Once at the ATM, users can quickly complete the authentication process and receive their cash.

The majority of the transaction is conducted through the app and the cloud, protecting sensitive information throughout the process.

“As a technology company, we are always considering what the future can bring, and today we have a great opportunity with Diebold Nixdorf to define the next wave of digital products to the ATM channel,” Daniel Goodman, MasterCard senior vice president of ATM product management, said in the release. “By bringing together the MasterCard network and Diebold Nixdorf’s large global scale, we can help move the ATM industry towards a globally scalable standard for driving digital innovation in the ATM channel.”

– atmmarketplace.com –