UK SEE 8% DROP IN CARD FRAUD

Markets across Europe have made significant gains in the fight against card fraud, specifically in France and the UK, which achieved 6% and 8% reductions. Despite this, losses across the EMEA region grew by €30 million.

The threat of card not present (CNP) fraud continues to be a key battleground for banks and retailers, as we now see a global migration of fraudulent activities. In the UK, we have seen a continued growth in online card utilisation but reduction in the success of fraud perpetrated within the channel. This has forced the fraudsters to migrate their efforts to new markets, with Austria, Denmark, Norway, Sweden, Poland and Russia all seeing an escalation in losses.

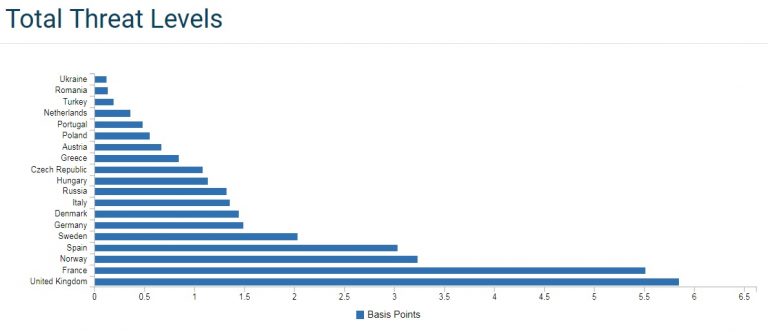

Despite being the top country in this chart, the UK reduced basis points losses from 7.00 in 2016 to 5.9, driven by improvements across all areas of card fraud but specifically in CNP fraud, which shows signs of continued reduction in 2018. Similarly, France reduced its fraud basis points from 8.9 to 5.5.

Fraud basis points is a standard measure of card fraud severity, and can show how a bank or a country is doing relative to others. 8.9 basis points is equivalent to 8.9 cents per €100. It works the same in any currency and provides an indicator of the fraud-to-sales ratio.

The UK alone now accounts for 47% of the losses reported within this report; the UK, France and Russia account for 77%. Losses within Germany, Spain and Italy continue to hold at a static level but we are seeing a desire to replicate the loss reductions seen in other markets.

HIGHLIGHTS:

- – UK losses fell 8% due to success battling card not present fraud

- – Total card fraud losses across the 19 European countries studied grew by €30 million, or 2%

- – The UK, France and Russia account for 77% of card fraud losses in EMEA

– paymentscardsandmobile.com –