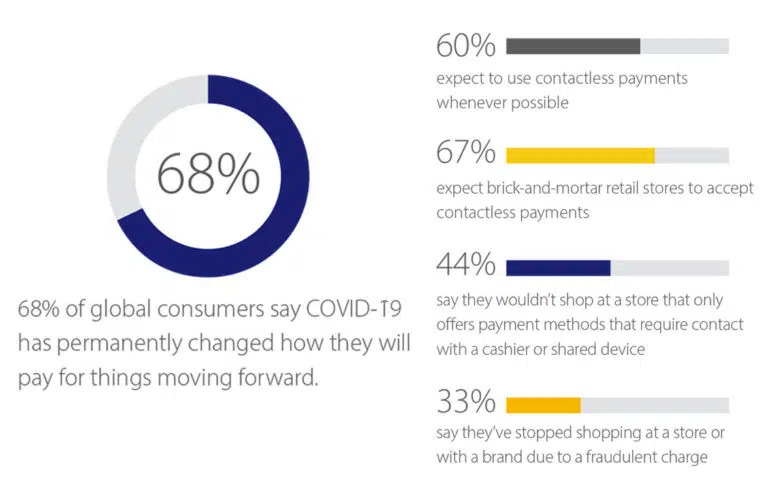

TWO IN THREE CONSUMERS WORLDWIDE SAY COVID-19 HAS PERMANENTLY CHANGED THE WAY THEY PAY

Just over two-thirds of consumers globally (67%) now expect bricks-and-mortar retail stores to accept contactless payments and just under half (44%) wouldn’t shop at a store that only offers payment methods that require contact with a cashier or shared device, a survey of merchants and consumers in nine countries around the world has found.

The fifth edition of The Visa Back to Business Study also found that 68% of consumers say that the Covid-19 pandemic has permanently changed how they make payments “with a preference on safer and touchless ways to pay” and that 60% expect to use contactless payments whenever possible in the next three months.

Nearly three-quarters of small businesses (74%) say they expect customers to prefer contactless payments as much or more than they do now in future and 40% identify contactless payments as “a critical investment area to meet a new wave of expectations”, according to the survey.

The survey also shows regional variations, with 73% of consumers in the United Arab Emirates saying they would not shop at a store where contactless payments are not accepted compared with 30% in Russia.

The percentage of consumers expecting retail stores to accept contactless payments also ranges from 54% in the USA to 69% in Germany, 74% in Russia, 75% in Canada and 82% in Ireland.

“The pandemic has dramatically increased consumers’ concern with touching cash and payment readers and correspondingly increased the desire to tap and pay,” Visa says.

“Stores that don’t accept contactless payments could run an increased risk of losing customers as a result.

“Previous research from Visa also found that, of the UK small businesses surveyed which were confident of bouncing back from the pandemic, two thirds (67%) said that their in-store experience for customers has improved due to the acceptance of contactless and digital payments.”

Survey participants included 2,250 small business owners in Brazil, Canada, Germany, Hong Kong, Ireland, Russia, Singapore, United Arab Emirates and the USA, 1,000 adult consumers in the US and 500 adult consumers in the other eight countries. It was conducted by Wakefield Research for Visa in June.

– NFCW –