Juniper: 70% growth in use of virtual card transactions globally

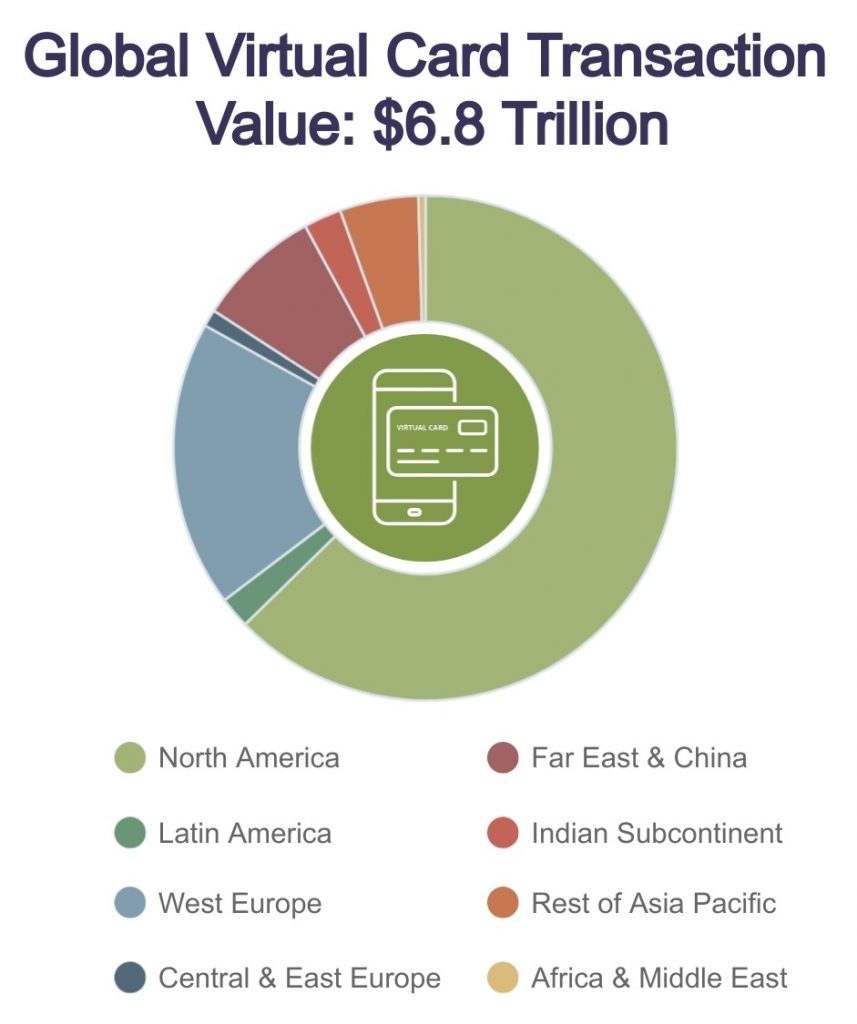

A new study by Juniper Research has found that the global value of virtual card transactions will reach $6.8 trillion in 2026, from $1.9 trillion in 2021.

Virtual cards, secure digital cards with randomly generated details, will show strong growth as they are increasingly used for B2B payments.

The research identified that businesses will value the simplicity of virtual cards, compared to the expensive and slow methods still being used, such as cheque payments, which remain popular in the US.

The new research predicts that outside of the dynamic B2B market, the added security from virtual cards will also appeal to the consumer market.

To capitalise on virtual card opportunities, vendors must identify which segment they are targeting and emphasise the most important value-added features, such as ERP integrations or consumer brand partnerships.

B2B Payments Dominating Transaction Value:

The report found that B2B payments will continue to account for the majority of virtual cards transaction value; totalling 71% of the total value in 2026.

While B2B sales occur less frequently, yielding under 1% of transaction volume in 2026, average transaction values are much higher in the B2B segment.

This means that vendors must ensure that security features and automation are emphasised to facilitate large payments as efficiently as possible.

Source: Paymentscardsandmobile